PACCAR Achieves Solid Third Quarter Sales and Profits

October 24, 2007, Bellevue, Washington PACCAR achieved very good revenues and net income for the third quarter and first nine months of 2007, said Mark C. Pigott, chairman and chief executive officer. PACCARs balanced global diversification, with over 60 percent of revenues originating outside of the U.S. and a double-digit revenue increase in the companys finance and aftermarket parts businesses contributed to solid operating performance. Strong demand for PACCAR products in Europe, Australia, Mexico and export markets continues to generate excellent earnings and provide opportunities for growth, tempered by truck industry declines in the U.S. and Canada. PACCARs total return to shareholders over the last four quarters was 56 percent compared to 16.5 percent by the S&P 500 during the same period.

PACCAR earned $302.3 million ($.81 per diluted share) for the third quarter of 2007 compared to $403.6 million ($1.07 per diluted share) earned in the third quarter last year. Third quarter net sales and financial services revenues were $3.76 billion. Net sales and financial services revenues for the first nine months of 2007 were $11.46 billion. PACCAR reported nine month net income of $966.2 million ($2.58 per diluted share), compared to $1.12 billion ($2.95 per diluted share) in 2006. This is the second highest nine months results in PACCARs 102-year history, said Mike Tembreull, vice chairman. This excellent performance demonstrates the benefit of global diversification and applied-technology investments throughout the company, which are delivering industry-leading quality, efficient manufacturing facilities and superior sales support programs.

PACCAR Completes Share Repurchase Program

During the third quarter of 2007, PACCAR invested $249.7 million to repurchase 4.58 million of its common shares (adjusted for the recent 50 percent stock dividend). These purchases complete the $300 million share repurchase authorization from its Board of Directors. PACCAR has invested $978 million to repurchase 27.4 million common shares in the last three years. The share repurchase programs reinforce the fact that PACCAR is an excellent long-term investment, said Mike Tembreull, vice chairman. The companys stock, including reinvested dividends, has outperformed the S&P 500 Index for the previous one-, three-, five- and ten-year time periods.

Quarterly Dividend Increase

The PACCAR Board of Directors approved an eight percent increase in the regular quarterly dividend to $.18 (eighteen cents), effective with the dividend payment on December 5, 2007, for shareholders of record on November 19, 2007. This marks the second dividend increase this year, resulting in a year-to-date dividend increase of 35 percent. PACCAR has increased its dividend an average of 20 percent per year during the last decade and has paid a dividend every year since 1941.

Financial Highlights Third Quarter 2007

Highlights of PACCARs financial results during the third quarter of 2007 include:

- Consolidated sales and revenues of $3.76 billion.

- Net income of $302.3 million.

- After-tax return on revenues of 8.0 percent.

- Share repurchases of $249.7 million.

- Record shareholders equity of $5.2 billion.

Financial Highlights Nine Months 2007

Financial highlights for the first nine months of 2007 include:

- Consolidated sales and revenues of $11.46 billion.

- Net income of $966.2 million.

- Cash provided by operations of $1.46 billion.

- Financial Services record pretax income of $207.9 million on assets of $10.7 billion.

- An annualized after-tax return on beginning equity of 28.9 percent.

- Record capital investments of $218.1 million.

Global Truck Market

The European economy continues to experience robust growth, shared Aad Goudriaan, DAF Trucks president. In the third quarter, business and consumer confidence remained strong and unemployment fell to a ten-year low. Industry truck sales in Western and Central Europe above 15 tonnes are excellent and could reach a record 320,000 units this year. It is estimated that the market could be a record 330,000-350,000 units in 2008. DAFs premium vehicles are the quality and resale value leaders in Europe and our goal is to achieve over 20 percent market share, noted Goudriaan. DAF is benefiting from strong growth in Central and Eastern European markets and is set to achieve record sales and profit in 2007. Sales and profits in Australia, Mexico and other international markets are also on pace to achieve record results in 2007.

In the U.S. and Canada, the industry prebuy in the second half of 2006, coupled with the impact of lower housing starts and automobile production, partially offset by good consumer retail sales has resulted in a sluggish Class 8 truck market, said Dan Sobic, PACCAR senior vice president. Industry retail sales are estimated to be 175,000-185,000 vehicles this year. Industry retail sales are projected to improve in 2008 due to normal replacement demand and be in the range of 210,000-240,000 vehicles. PACCARs year-to-date 2007 retail market share of the U.S. and Canadian Class 8 market has risen to a record 26.5 percent from 25.3 percent for 2006.

Investments in Technology and Products

PACCARs financial strength enables the company to invest in information technology, facility enhancements and innovative new product initiatives during every phase of the business cycle, said Jim Cardillo, PACCAR executive vice president. Ongoing investments include:

- Construction of PACCARs new $400 million engine production facility and technology center in Columbus, Mississippi began in July. The technologically advanced and environmentally friendly facility is scheduled for completion in 2009 and will incorporate leading-edge diagnostic applications in both the production and development processes. PACCARs premium 12.9-liter and 9.2-liter diesel engines manufactured in Columbus will be installed in Kenworth and Peterbilt vehicles and could be exported to meet DAFs growing production requirements.

- PACCARs new purchasing/sales office in Shanghai, China is fully operational and offering cost-effective sourcing opportunities for worldwide production and aftermarket parts sales, noted Tom Lundahl, PACCAR vice president, purchasing. Sales of PACCAR powertrain components to the Asian market are an important focus of the new office.

- DAF unveiled its new 76,000-square-foot engine test and research facility in Eindhoven, The Netherlands, in June 2007. The research and development center includes twenty world-class test cells that are instrumental in the development of new PACCAR global engines, said Aad Goudriaan.

- Kenworth completed a 105,000-square-foot expansion and renovation of its plant in Chillicothe, Ohio, in June. The expanded use of robotics, logistics and radio frequency identification (RFID) are contributing to streamlined operations and an overall 20 percent improvement in quality, productivity and efficiency.

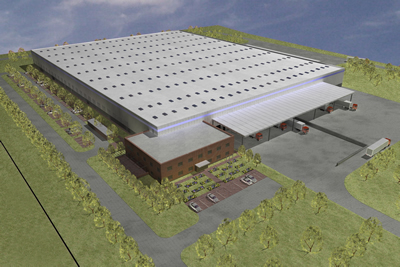

- Groundbreaking of PACCARs new state-of-the-art Parts Distribution Center near Budapest, Hungary, in September was attended by U.S. Ambassador April Foley, Dutch Ambassador Ronald Mollinger, and senior Hungarian state and local officials. The 269,000-square-foot facility, scheduled for completion in mid-2008, is strategically located to provide daily aftermarket parts support to the growing base of DAF dealers and customers in Central and Eastern Europe.

PACCARs new Parts Distribution Center in Hungary will open in mid-2008.

Six Sigma and Lean Manufacturing Add Savings and Increase Capacity

PACCARs application of Six Sigma tools together with Lean Manufacturing techniques have realized cumulative benefits of $1.5 billion since 1998, commented Helene Mawyer, PACCAR vice president. Six Sigma and Lean projects are ongoing at all PACCAR facilities, effectively increasing capacity and generating efficiency gains.

Environmental Leadership

PACCARs environmental leadership is underscored by the innovative technologies being implemented in new hybrid vehicles as well as in manufacturing and distribution facilities throughout the company, said Tom Plimpton, PACCAR president. The increase in fuel prices worldwide has highlighted the advantages of PACCARs hybrid vehicles, which are estimated to deliver 30 percent better fuel economy than traditional commercial vehicles.

PACCAR hosted the Hybrid Truck Users Forum (HTUF) (www.htuf.org) in Seattle in September. Kenworth and Peterbilt demonstrated hybrid vehicles designed for urban pick-up and delivery, utility, heavy-duty long haul and hydraulic refuse applications. This forum was the largest gathering of hybrid-commercial-vehicle-focused companies in the world.

PACCAR and Eaton Corporation are jointly developing proprietary hybrid technology for heavy-duty commercial vehicles in North America. The innovative new products will be introduced exclusively in Kenworth and Peterbilt trucks in the North American market, targeted for initial production by the end of 2009. PACCAR and Eaton Corporation are also jointly developing diesel-electric technology for Kenworth, Peterbilt and DAF medium-duty hybrid trucks, with production beginning next year.

The Peterbilt Hybrid 335 is estimated to achieve a 30 percent improvement in fuel economy.

DAF showcased its updated range of premium-quality models, including Euro 5 versions of the LF model, at the October European Road Transport Show in Amsterdam. DAF has been a leader in engine development for 50 years, said Ron Borsboom, DAF chief engineer. DAF is one of the first manufacturers to deliver vehicles compliant with new emission requirements well ahead of the 2009 deadline.

Industry Awards

Kenworth Truck Company achieved the highest ranking in customer satisfaction among Class 8 truck owners in the Over The Road, Pickup and Delivery, and Vocational Segments, according to the recently released J.D. Power and Associates 2007 Heavy Duty Truck Customer Satisfaction StudySM*. Kenworth is the first truck manufacturer to sweep all three major product segment awards since the customer satisfaction survey was introduced, said Bob Christensen, PACCAR vice president and Kenworth general manager. Kenworth has an outstanding record of delivering the highest levels of customer satisfaction in the industry in terms of performance, quality and low cost of ownership. Since 1999, PACCAR has earned 23 J.D. Power awards while the closest competitor has earned nine.

Financial Services Companies Achieve Record Revenues and Earnings

PACCAR Financial Services (PFS) assets climbed to a record $10.7 billion. The PFS portfolio, consisting of more than 168,000 trucks and trailers, includes PACCAR Financial Europe, with over $2.6 billion in assets and PACCAR Leasing, a major full-service truck leasing company in North America and Europe, with a fleet of over 31,500 vehicles.

Record quarterly pretax income of $73.4 million was ten percent higher than the $66.7 million earned in the third quarter last year. Third quarter revenues rose to $313.2 million compared to $246.2 million in the same quarter of 2006. For the nine-month period, revenues increased to $864 million from $690.1 million during the same period a year ago and pretax income rose by 15 percent to a record $207.9 million compared to $181.2 million in 2006. PACCAR Financial Services profitably supports the sale of PACCAR trucks in 18 countries with a comprehensive portfolio of finance, lease and insurance products, said Ken Gangl, senior vice president. Record assets, solid margins, strong credit quality and rigorous portfolio management are providing excellent earnings. PACCARs superb balance sheet, complemented by its AA- credit rating, enabled the company to continue to grow its asset base and meet its funding needs even as many other companies liquidity was interrupted due to turbulent credit markets worldwide.

PACCAR is a global technology leader in the design, manufacture and customer support of high-quality light-, medium- and heavy-duty trucks under the Kenworth, Peterbilt and DAF nameplates. It also provides financial services and information technology and distributes truck parts related to its principal business.

PACCAR will hold a conference call with securities analysts to discuss third quarter earnings on October 24, 2007, at 9:00 a.m. Pacific time. Interested parties may listen to the call by selecting Live Webcast at PACCARs homepage. The Webcast will be available on a recorded basis through October 31, 2007. PACCAR shares are listed on the NASDAQ Global Select Market, symbol PCAR, and its homepage can be found at www.paccar.com.

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act. These statements are based on managements current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those included in these statements due to a variety of factors. More information about these factors is contained in PACCARs filings with the Securities and Exchange Commission.

| * | J.D. Power and Associates 2007 Heavy Duty Truck Studysm. Study was based on 2,677 responses from principal maintainers of heavy-duty trucks. For more information please go to www.jdpower.com. |